What Prince and Jimmy Buffett Can Teach Us About Estate Planning

When we think of celebrities like Prince and Jimmy Buffett, we picture fame, fortune, and a life of luxury – not probate court, family feuds, and expensive legal battles. But even with millions of dollars and access to top-tier advisors, both artists left behind estate planning lessons that apply to everyone, not just the rich and famous.

Here’s what their stories teach us, and how you can avoid the same mistakes in your personal life.

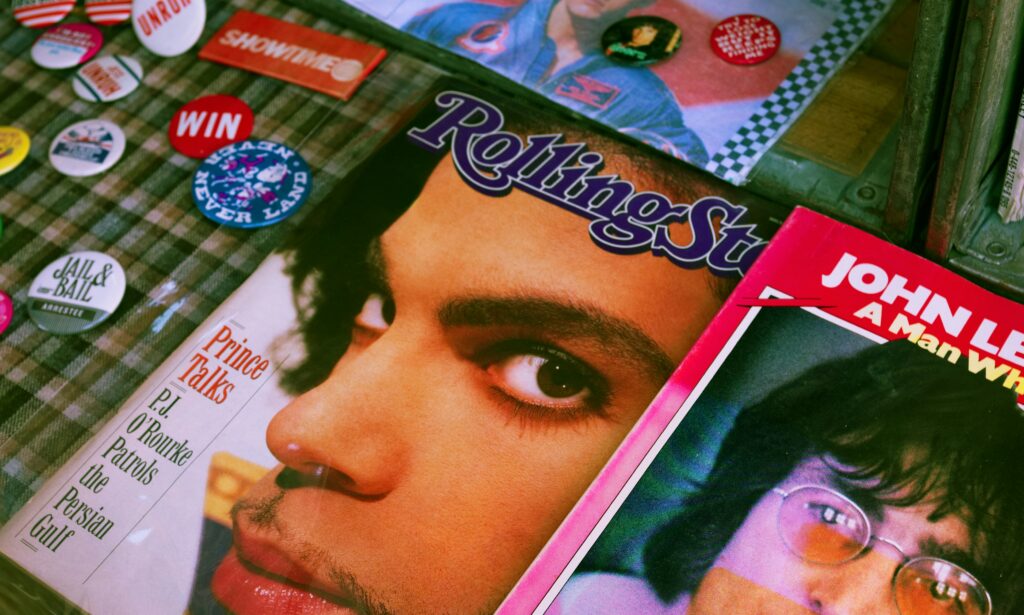

Prince: The High Cost of No Plan

Prince passed away in 2016 with an estate valued at over $150 million – and no will. That meant his assets were distributed based on Minnesota’s intestacy laws, not his personal wishes. His sister and five half-siblings became heirs, but the absence of a plan created six years of conflict, delays, and courtroom drama during probate.

To this day, Prince’s estate is still tied up in legal disputes, particularly around the business interests and legacy management of Prince Legacy LLC. What could’ve been a smooth transition has become a near decade-long saga filled with infighting, lawsuits, and mounting legal costs.

“Prince’s estate showed us what happens in Minnesota when there’s no will. The law steps in and picks your beneficiaries. Estate planning isn’t just about having documents; it’s about choosing the right people who can work together to carry out your wishes.”

— Sarah Sicheneder, Founder & Attorney at Law at Everbright Legacy Law

Jimmy Buffett: Planning Ahead Isn’t Always Enough

Jimmy Buffett, who passed in 2023, did leave behind a thoughtful estate plan – complete with a will and a trust designed to provide for his wife, Jane. But trouble still found its way in.

Jane and her co-trustee, Richard Mozenter (Jimmy’s longtime business advisor), are now locked in a legal battle. She accuses him of withholding information and overcharging; he claims she’s interfering with trust operations. And this all centers around a massive $275 million estate.

Buffett’s plan was solid, but a strained relationship between co-trustees has caused disruption, stress, and more time spent in court.

“Getting your estate plan done is like stocking the bar in Margaritaville – it’s only half the party. Fiduciaries like trustees and personal representatives must get along when you are no longer around. It’s not just about who gets what. It’s also about who can work together to make sure it lasts.”

— Sarah Sicheneder, Founder & Attorney at Law at Everbright Legacy Law

How to Protect Your Own Legacy

Good news: you don’t need millions to benefit from smart estate planning. Whether your estate is large or modest, you can take a few key steps so that your family is protected after you’re gone:

- Create a complete plan: Include a will, trust, healthcare directives, and powers of attorney.

- Choose the right people: Fiduciaries should be responsible, impartial, and ideally not emotionally entangled.

- Communicate your wishes: Let your family know your intentions while you’re still here.

- Review regularly: Life changes – your estate plan should reflect those changes, too.

Don’t Leave It to Chance: Plan Your Legacy Today

Prince’s estate has been tied up for years. Buffett’s estate is already in court despite careful planning. These stories aren’t about celebrity gossip; they’re real-world examples of how things can go wrong.

Estate planning isn’t just for the wealthy. It’s for anyone who wants to spare their loved ones unnecessary stress. It’s not an easy or glamorous process, but it certainly beats spending six years in probate and nearly a decade fighting in court. If your plan is outdated (or if you don’t have one at all), now is the time.

Contact our office today to speak with an experienced estate planning attorney about creating a will, trust, or auditing what you already have in place. It’s a simple step that could save your family years of heartache and headaches.